Residential vs Commercial Property: Which Investment is Better in 2025?

Investing in real estate has always been one of the most reliable ways to build long-term wealth. However, in 2025, with new market dynamics and shifts in demand and lifestyles, many investors are asking: Residential vs Commercial Property—which is the best investment?

In this blog, we will discuss each property type, the pros and cons of each type, and the best real estate investment strategies to determine what is the best place to invest in this year.

What is residential property investment?

Residential property investment is acquiring houses, apartments, or land for personal living or to earn rental income. With continued growth and demand for accessible housing in India, particularly in cities and emerging locations like Uttarakhand, residential real estate is inviting new buyers.

Key Benefits of Residential Investments:

- Lower Entry Cost – Residential properties are usually cheaper than commercial properties.

- Families, students, and working professionals consistently need housing, ensuring a constant demand.

- Easier Financing—Home loans from banks can be financed easier and at lower interest rates than commercial properties.

- Rental Opportunities – The rising demand for rental houses guarantees an ongoing profit stream.

What is commercial property investment?

Commercial property investments include offices, retail outlets, warehouses, and industrial properties. As a result of the growth of start-ups, co-working spaces, and e-commerce, demand for commercial spaces is set to quickly rise in 2025.

Key Benefits of Commercial Investments:

- Higher Returns—Commercial renters typically provide better rental yields than residential.

- Long-Term Tenants – Businesses generally sign much longer rental agreements, providing peace of mind.

- Appreciation Potential – Commercial centers in growing municipalities can appreciate dramatically.

- Diversification—A great way to diversify your portfolio if you are only used to housing investments.

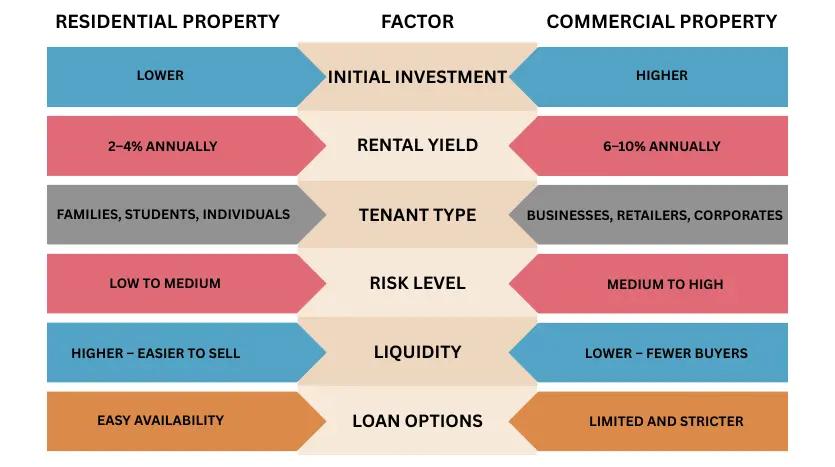

👉 This comparison clearly highlights the major factors that influence residential vs commercial property investment decisions in 2025.

Real Estate Investment Strategies for 2025

- Location First – Always choose locations based on strong infrastructure, growth potential, and connectivity.

- Diversify Portfolio—Always try to maintain a portfolio that is balanced between residential and commercial, to mitigate risk.

- Focus on Passive Income—Always choose a property that produces reliable passive income from real estate by renting it out.

- Keep an Eye on Trends—There are developments like co-living spaces, sustainable homes, and collaboration or flexible workspaces that are in demand.

- Work with Experts—Work with developers you can trust, like Rasheshwari Builders, who know and understand the local market.

Which Should You Choose in 2025?

If you are a first-time investor or seeking a safer entry point, residential property investment is a great option because of the price point and consistent demand.

If you have more capital available and are seeking greater rental yields, perhaps commercial property investment is the better path for you.

In conclusion, the best option for you will depend on your budget, long-term goals, and risk appetite.

Final Thoughts

The debate around Residential vs Commercial Property will always exist, but 2025 presents exciting opportunities in both segments. With the right planning and strategy, you can secure not only appreciation in value but also passive income from real estate.

At Rasheshwari Builders & Consultants, we specialize in helping you make the right choice—whether it’s a dream home in the serene hills of Uttarakhand or a smart investment for future growth.

Contact us today at rasheshwaribuilders@gmail.com to explore the best investment opportunities.